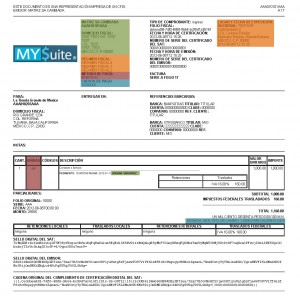

Starting July 1st 2012, changes from the SAT’s Appendix 20 will come into force. This implies an update to the CFD and CFDI. This type of receipts will move to version 3.0 and 3.2.

The new mandatory fields are the following:

- Quantity unit

- Mean of payment

- Tax regim of the sender

- Place of sending

The new optional fields for digital invoices are the following:

- Account number

- Exchange rate

- Currency

In case the client pays with partial amounts, a fiscal receipt will be generated for the total amount of the operation (and indicating the case) then a digital invoice for each payment.

In order to get used to these new rules, MYSuite prepared a presentation (in Spanish) you can download. We invite our customers to be ready by reading these pages about the platform changes.